Daycare Fee > USA

Daycare Cost in USA: Understanding Fees, Policies, and National Programs

Starting or managing a daycare in the USA is an exciting yet challenging venture. Whether you’re an entrepreneur looking to open a daycare or a parent navigating the world of childcare, understanding daycare costs in the USA is crucial. This guide will break down what influences daycare fees, key national policies, available subsidies, and how local and federal regulations shape the daycare industry. Let’s dive into everything you need to know about daycare costs in the USA.

What Influences Daycare Costs in the USA?

Daycare costs across the USA vary widely, but several common factors influence fees nationwide:

- Location: Urban areas and regions with a higher cost of living tend to have more expensive daycare rates.

- Staffing: Daycare centers must meet federal and state staff-to-child ratio requirements, and qualified caregivers demand competitive wages. Quality staffing is one of the largest contributors to daycare costs.

- Facilities and Licensing: Daycare providers must maintain high standards for safety, cleanliness, and facilities, and obtaining and renewing licenses costs money.

- Demand and Supply: High demand for daycare services in certain areas can drive up costs, particularly when there’s a shortage of quality providers.

Understanding these factors can help daycare entrepreneurs develop a fair and profitable fee structure while helping parents understand why daycare fees may seem high in some regions.

National Policies and Regulations Impacting Daycare Costs in the USA

Daycare businesses and parents alike are affected by several federal policies and programs designed to ensure childcare affordability and quality. Here are some national regulations and policies that play a role in shaping daycare costs:

1. Child Care and Development Fund (CCDF)

The CCDF is the largest federal program supporting low-income families in accessing affordable childcare. States receive federal grants to subsidize childcare costs for eligible families. If you’re a daycare provider, understanding this program can help you serve more families and ensure steady revenue through subsidized care payments.

2. Federal Tax Credits

The Child and Dependent Care Tax Credit (CDCTC) is a critical benefit for families that can significantly reduce their daycare costs. Families can claim a portion of daycare expenses on their federal tax return, with credits ranging from 20% to 35% of expenses (up to $3,000 for one child or $6,000 for two or more).

As a daycare provider, understanding how this credit works can help you market your services to parents who may not realize they qualify for tax benefits to offset daycare costs.

3. Staffing and Safety Requirements (Child Care Development Block Grant Act)

The Child Care and Development Block Grant (CCDBG) Act is a federal law that sets nationwide safety standards for child care providers. These include:

- Staff training and background checks

- Health and safety regulations

- Compliance with staff-to-child ratios

While these regulations ensure quality, they also contribute to operating costs. Entrepreneurs need to be prepared for the upfront investment in training, background checks, and facilities.

National Subsidies and Assistance Programs for Daycare

The U.S. government offers several subsidy programs that help both daycare providers and families afford childcare. Understanding these programs is essential for daycare entrepreneurs who want to offer affordable options while maintaining profitability.

1. Child Care Subsidies through CCDF

Low-income families can apply for subsidies under the Child Care and Development Fund (CCDF). The government pays a portion of the child care costs directly to the provider, helping parents afford care while giving providers steady, reliable payments.

2. Head Start and Early Head Start Programs

The Head Start and Early Head Start programs provide free or reduced-cost childcare services for low-income families. These programs are often housed within daycare centers or schools, offering high-quality care for children from birth to age 5.

- For Daycare Owners: You can explore opportunities to partner with these programs to increase your daycare’s reach and provide much-needed services to eligible families.

3. Military Child Care Fee Assistance

The Department of Defense offers military families financial assistance for child care costs, making it more affordable for service members to access quality daycare services outside of military bases. If your daycare is located near a military base, consider this subsidy program as an option for military families.

Key Authorities Regulating Daycare in the USA

Several federal and national agencies regulate daycare operations in the USA, ensuring daycare centers comply with safety, educational, and operational standards. Familiarity with these organizations is essential for daycare owners:

- Office of Child Care (OCC): Oversees the distribution of federal child care funds through the CCDF and ensures compliance with federal daycare regulations.

- Department of Health and Human Services (HHS): Responsible for administering the Head Start and Early Head Start programs, as well as establishing national childcare standards.

- U.S. Department of Labor (DOL): Enforces labor laws that impact daycare staffing, such as the Fair Labor Standards Act (FLSA) and wage and hour requirements for childcare workers.

Daycare Costs Across States: What’s the Range?

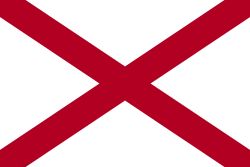

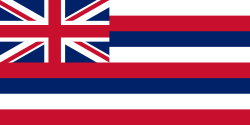

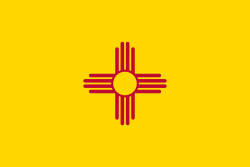

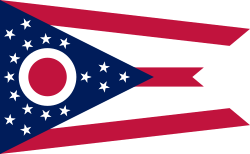

While we’ve covered the national influences, daycare costs can fluctuate dramatically depending on the state. For a detailed breakdown of fees and regulations in each state, visit our state-specific pages below:

Explore the full list of daycare fees by state to understand how much daycare might cost in your region and what local policies affect pricing.

How to Make Daycare More Affordable

For families and daycare entrepreneurs alike, understanding the available subsidies and tax credits can make a significant difference in managing daycare costs. By tapping into federal and state resources, you can ensure high-quality childcare while reducing the financial burden on both providers and parents.

If you’re a daycare owner, consider accepting child care subsidies like the CCDF or partnering with Head Start to offer affordable options for families. Parents, on the other hand, should explore their eligibility for federal tax credits and subsidy programs to make daycare costs more manageable.

Final Thoughts on Daycare Costs in the USA

The daycare cost in the USA is shaped by a variety of factors, from staffing and facility requirements to federal regulations and subsidies. Whether you’re a parent trying to balance your budget or an entrepreneur building a daycare business, understanding the intricacies of these costs can help you make informed decisions.

For more detailed information on daycare fees in your state, be sure to check out our state-specific guides. Each state has unique regulations, subsidies, and cost factors that can affect your daycare options.